If you’re a business owner or commercial landlord trying to recover money owed, you’ve probably asked:

Should I send a demand letter first… or just file suit?

A well-written demand letter can resolve a dispute quickly and cheaply. But in the wrong situation, it’s just a delay that helps the other side stall, lawyer up, or move assets.

This guide gives you a practical Florida-focused framework to decide which path makes sense—plus a “hybrid” strategy we often use when clients want results without wasting time.

⚠️ Important: This article is general information, not legal advice. The best approach depends on your contract terms, evidence, and goals.

What a demand letter is supposed to do (when it’s done right)

A demand letter should do more than “ask for payment.” It should:

✅ Clarify the facts (who owes what, and why)

✅ Show proof (contract, invoices, ledger, key emails/texts)

✅ Create a clean written record for court (if needed)

✅ Set a deadline that creates urgency

✅ Offer a clear “off-ramp” (pay, cure, surrender, or settlement)

If the letter doesn’t accomplish those things, it usually doesn’t create leverage.

When a demand letter is worth it

Demand letters tend to work best in these situations:

✅ 1) The other side can pay (and prefers to avoid a lawsuit)

If the recipient is a real operating business (or a tenant still operating), a demand letter can motivate payment simply because they want to avoid:

- public litigation

- business disruption

- attorney’s fees exposure (if the contract allows it)

✅ 2) Your documentation is strong

You’re in a better position when the story is simple and provable:

- written contract / lease

- clear pricing

- proof you performed

- clear balance due

✅ 3) The problem is a misunderstanding—not a bad actor

Demand letters are effective when the dispute stems from:

- accounting errors

- staff turnover

- missing paperwork (like change orders)

- misapplied payments

- unclear scope expectations

✅ 4) You want a fast business outcome

Sometimes the right result isn’t “win a lawsuit two years from now.” It’s:

- getting paid

- getting the property back

- setting a move-out date

- reaching a short payment plan with enforceable terms

A demand letter can be the fastest path to that outcome.

When a demand letter is a waste of time (and can actually hurt you)

Here are the biggest red flags.

🚩 1) You’re being strung along

If you keep hearing:

- “Next week.”

- “Send it again.”

- “Our accountant is out.”

- “We just need one more document.”

…you may be financing delay.

🚩 2) You suspect asset movement or shutdown

If the debtor is closing locations, moving inventory, dissolving the entity, or operating under a new LLC, a demand letter can give them a head start.

🚩 3) You need quick action—possession or court relief

If you need possession of property, an injunction, or immediate relief, a demand letter often won’t move fast enough.

🚩 4) The letter forces you to reveal weaknesses

A sloppy demand letter can backfire if it:

- makes admissions

- misstates the law

- demands the wrong amount

- names the wrong parties

- fails to attach the supporting documents

Sometimes the best move is to prepare the lawsuit first, then decide what to send.

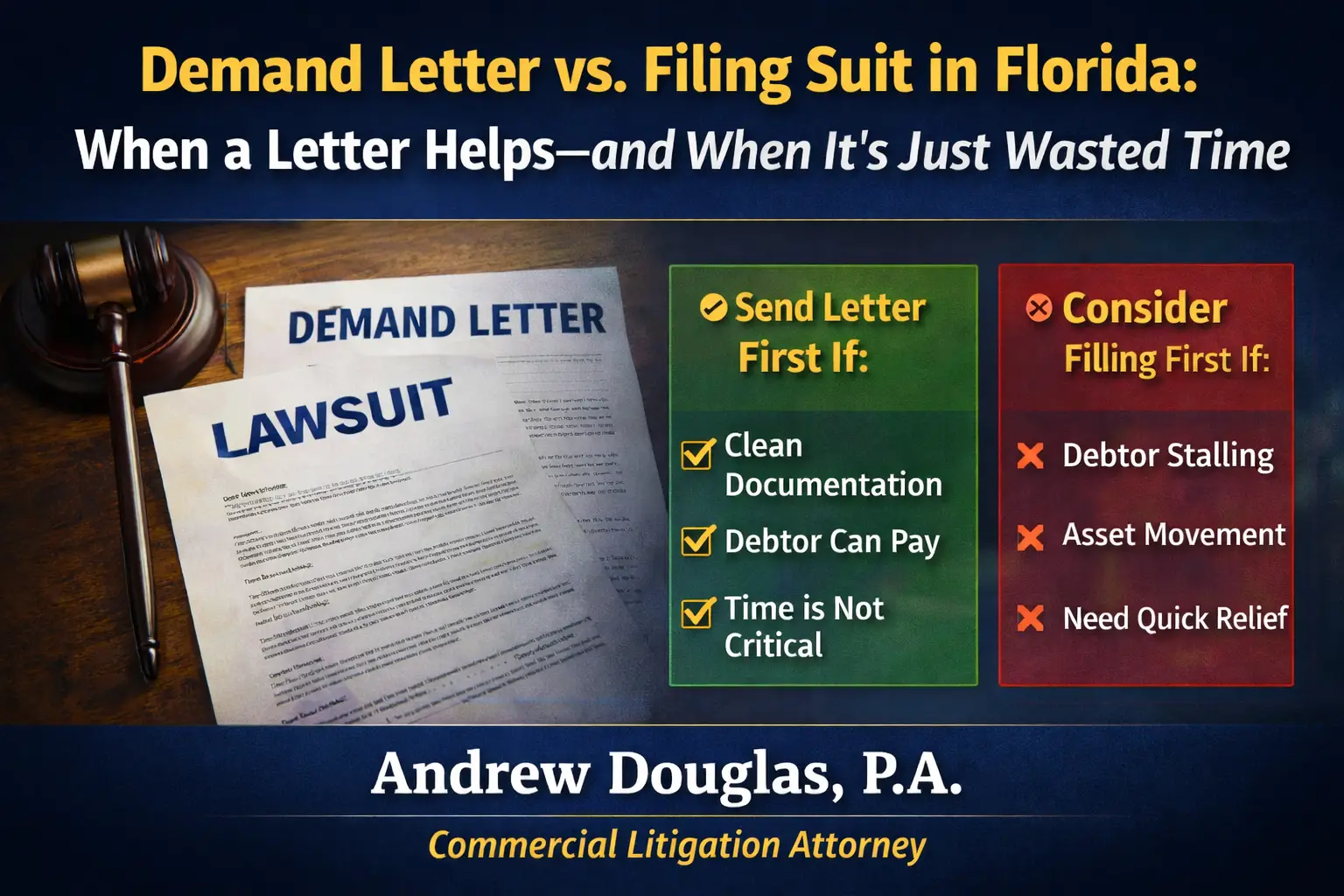

Quick decision tool: letter or lawsuit?

✅ Send a demand letter first if:

✔️ You have clean documentation

✔️ You believe they can pay

✔️ Time isn’t your enemy

✔️ You want a fast resolution without filing

✔️ You can give a short deadline without losing leverage

⚠️ Consider filing first if:

✘ The debtor is stalling or has broken promises

✘ You suspect asset movement or a shutdown

✘ You need fast possession or court-ordered relief

✘ A deadline is approaching (contractual deadlines or statute of limitations)

✘ The dispute is already “lawyered up”

The best strategy in many Florida disputes: the “hybrid” approach

In a lot of real-world cases, the most effective approach is:

✅ Step 1: Prepare the lawsuit first

(Identify the correct parties, calculate the amounts, assemble exhibits.)

✅ Step 2: Send a short demand letter with a tight deadline

(Your letter becomes leverage—not delay.)

✅ Step 3: File immediately if the deadline passes

(This avoids months of “we’ll pay next week.”)

This approach keeps you in control and prevents the demand letter from becoming a stalling tactic.

How long should you give them to respond?

In many business disputes, 7 to 10 days is enough to separate:

- someone who intends to resolve the matter, from

- someone who intends to stall.

Long deadlines (30+ days) often backfire—especially if you’re losing money each week.

What to include in a demand letter that actually works

A strong demand letter typically includes:

✅ Correct legal names (tenant entity, business entity, and any guarantor)

✅ Short fact summary (clear, professional, not emotional)

✅ Exact dollar demand and how it’s calculated

✅ Copies of key documents (contract/lease, invoices, ledger, texts/emails)

✅ A clear deadline + how payment should be made

✅ “Reservation of rights” language (avoid waiving remedies)

✅ A realistic resolution option (payment plan / move-out agreement)

Common mistakes that reduce leverage (and why they matter)

🚫 Threatening language or personal attacks → makes settlement harder

🚫 Overstating the law → undermines credibility

🚫 Demanding amounts you can’t prove → invites disputes and delay

🚫 Sending to the wrong address / ignoring notice provisions → weakens your position

🚫 Leaving out the guarantor → often leaves money on the table

🚫 Giving an overly long deadline → encourages stalling

Two real-world examples (Florida)

Example 1: Commercial landlord / tenant still operating but not paying

If a commercial tenant is still operating but not paying rent, a demand letter can help if it’s tied to a real plan (deadline + readiness to file). In many of these cases, the hybrid approach is the best path because it avoids endless promises while the tenant continues generating revenue.

Example 2: Business invoice / contract balance owed

If you have a signed agreement, clear scope, and an unpaid balance, a demand letter can often resolve matters quickly—especially when the recipient wants to avoid litigation costs and disruption.

FAQ

Do I have to send a demand letter before filing suit in Florida?

Sometimes contracts require notice and an opportunity to cure. Many do not. The best practice depends on your agreement, your evidence, and whether time is helping or hurting you.

Can a demand letter help me recover attorney’s fees?

Only if a statute or your contract allows it. A demand letter can still be useful to frame the dispute around fee/interest provisions when they exist.

What if they ignore the demand letter?

That’s the point of a short deadline: if they ignore it, you move to the next step with momentum.

How our firm helps

Andrew Douglas, P.A. represents Florida business owners and commercial landlords in disputes involving unpaid balances, contract breaches, and lease enforcement. Clients typically come to us because they want a smaller-firm approach: responsive communication, practical strategy, and efficient action—whether that’s a demand letter, a filing, or both.